Capone tax evasion trial: 90 years ago, the T-Men had the goods on Mob chief

Part 1: Witnesses detail Capone’s untaxed income from an array of illegal operations

First of two parts.

Spectators gathered outside each doorway to the U.S. District Court building in Chicago in the fall of 1931, hoping to see gangland leader Al Capone arrive for his trial for alleged tax evasion. Capone, surrounded by police, used a side entrance and sauntered briskly past photographers down the crowded hall to the courtroom. A judge earlier had barred the public – except for the press – from his pre-trial hearings.

But the large chamber proved no refuge. About 30 reporters soon converged on Capone as he strolled to the defense table. He wore a silk shirt, pearl-gray spats, polished brown shoes and white powder smeared over his scarred, jowly face. The reporters treated him like the celebrity he was. One asked if he had lost any weight from his 260-pound frame, while another questioned him about the shade of blue of his fedora.

“Are you worried?” one inquired, more to the point.

“Well, to be frank with you, who wouldn’t be?” he said.

Moments later, federal Judge James H. Wilkerson asked ceremoniously, “Is the defendant in the court?” and bade Capone to enter a plea to grand jury indictments of 22 counts of allegedly evading federal income taxes – one a single count for 1924 and the other with 21 counts from 1925 to 1929.

“Not guilty,” Capone said twice.

It was the most anticipated trial ever of an American mobster, its daily activities making the front pages of hundreds of newspapers. Capone at the time held worldwide notoriety as a ruthless rackets leader, believed to be linked to scores of murders while earning hundreds of millions on illegal beer and liquor, prostitution, a half-dozen illicit gambling casinos, several breweries and dog tracks, and about 1,200 speakeasies protected by outright bribery of Chicago-area police, the courts and elected officials. Federal Treasury and Justice Department agents had worked for more than two years building a case against Capone.

On October 6, 1931, Capone watched as jury selection started. Sixty prospective jurors entered the courtroom, quietly taken from a pool assigned to a separate case to throw off attempts by the powerful crime lord’s men to influence them. Federal prosecutors submitted a list of 75 witnesses to appear to make their case.

For Capone, the trial was an all-in proposition. Weeks earlier, in June, he tried to earn a lenient sentence by pleading guilty to the two tax evasion indictments. He also conceded his guilt to an astonishing list of 5,000 charges related to a suspected conspiracy with 68 others to violate federal Prohibition laws. The bootlegging accusations resulted from the painstaking efforts of the Justice Department’s Volstead Act enforcement crew in Chicago, headed by Special Agent Eliot Ness, that the local press called “The Untouchables.”

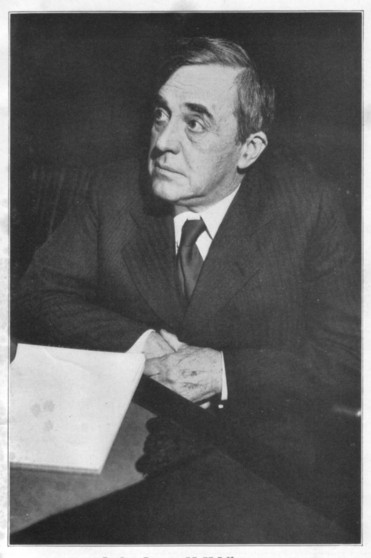

Capone’s criminal trial lawyers, the flamboyant, cane-supported Albert Fink and his less-courtroom savvy cohort Michael Ahern, won a deal with the lead prosecutor, U.S. Attorney George E.Q. Johnson, to limit Capone’s potential prison sentence to as little as 18 months in exchange for a guilty plea on the tax and booze law violations. Johnson made the settlement offer out of concern the case would be difficult to win at trial and the fact that appeals could go on for years.

However, the pact was too deferential for the no-nonsense Judge Wilkerson. The judge made it clear he would not be duty bound to approve the prosecutor’s tentative agreement.

Not only had Treasury and Justice invested a lot of time and effort into the outcome, but President Herbert Hoover himself had applied political pressure to “get Capone” since the 1929 St. Valentine’s Day massacre in Chicago that killed seven Capone rivals. The U.S. government, in the person of Wilkerson, would not go easy on a Mob boss. It wasn’t just about him paying what he owed to the IRS and be done about it. The judge a year earlier presided over the tax evasion trials of Al’s brother Ralph “Bottles” Capone, and Capone’s top men Frank Nitti and Jake “Greasy Thumb” Guzik, and sentenced each to the federal prison at Leavenworth.

The government regarded those cases as a prelude to throwing the book at the big man in 1931. Wilkerson leaned on Al. To consider granting the plea deal, the judge added a caveat – Capone would have to take the stand and answer the judge’s direct questions related to the criminal charges regardless of the guilty plea. Capone balked. He didn’t want the attention nor take the chance of incriminating himself further. Ahern moved to withdraw the guilty plea.

Wilkerson then shelved the potentially controversial 5,000 liquor conspiracy claims – filed when the public was having its fill of the ineffective, 11-year-old Volstead law – to serve as a backup case if needed. Instead, he opted to pursue the 23 tax evasion counts (a mixture of felonies and misdemeanors) against Capone and eventually ordered the mobster’s trial to commence the first week of October.

Much of the government’s evidence originated from ledgers detailing earnings from customer losses from roulette, craps, horse races for Capone, brother Ralph, Guzik and some lower-level Outfit hoods at The Ship, one of his gambling houses in Cicero, from 1924 to 1926. Prosecutors bolstered their case with eyewitnesses, including former Capone employees Fred Reis, who testified in Guzik’s tax evasion trial, and Lou Shumway. Both men made entries in the house’s ledgers.

By 1930, or even 1929, Capone’s Outfit had a secret overseer – Johnny Torrio, its former chief before a supposed retirement to New York in 1925, leaving control of the liquor gang – temporarily, as it turned out – to Al. Torrio served as Chicago’s rep with what was then called the national “Combination” of crime families, who repudiated Al after the 1929 massacre. Taking regular plane fights to Chicago, Johnny quietly presided over a loose partnership between the Outfit and the city’s North Side gang. When Capone and his top men faced IRS problems in 1930, Torrio convinced Al to let Lawrence Mattingly, Torrio’s own tax lawyer, take over his case.

Mattingly would prove to be a turning point for Capone’s prospects, and not a good one. Before the trial, Mattingly tried to sell the government on a plan in which Al would admit to evading income taxes, make good on them, pay a fine and receive no jail time in return. Mattingly also got Capone to agree to an interview with Treasury officials. But during the interviews, Capone deferred to his attorney when asked about his income. So Mattingly offered to provide Treasury with a letter delineating Capone’s income for reasons of a negotiated settlement without prison.

Months later, in late 1930, Mattingly provided the document – later dubbed “the confessional letter” by the press – to Treasury agents. He maintained that Capone made a salary of only $75 a week as an employee – for Outfit gang leader Torrio – in 1924 and 1925 while supporting a wife, son, widowed mother, brother and sister. He admitted Capone later earned incomes of about $26,000 and $40,000 “respectively” for 1926 and 1927 and then not more than $100,000 for 1928 and 1929. The letter backfired. The feds would effectively use it in court to argue that Capone admitted to earning untaxed income while a member of a criminal organization.

Members of the jury empaneled on October 6 included grocers, painters, a pattern maker, hardware merchant, insurance agent, stationary engineer, farmer and clerk. Capone’s lawyers objected, saying the jurors were from the rural outskirts of Cook County, and not Capone’s inner-city peers. Wilkinson approved the panel anyway.

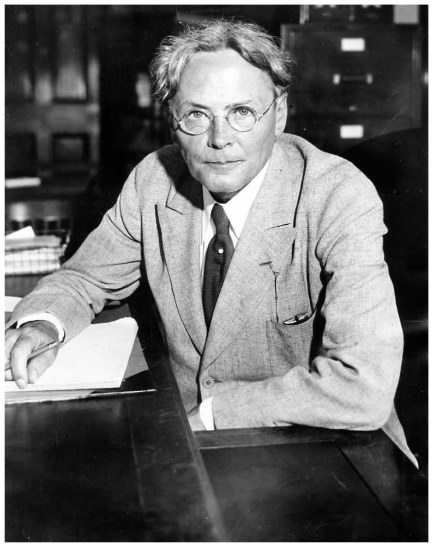

The formal proceedings began on October 7 with an opening statement by Assistant U.S. Attorney Dwight Green about the two indictments. He claimed Capone failed to file tax returns from 1924 to 1929 and knowingly shirked exactly $215,080.48 in U.S. taxes owed on an income of $1,038,654.84 (about $18.6 million today).

The first witness was Charles Arndt, a director of the Bureau of Internal Revenue in Illinois, who, based on his records, backed Green’s assertion that Capone never filed for taxes from 1924 to 1929. The next witness, Chester Bragg, a citizen activist in Cicero, described how he and other townsfolk in 1925 went on an organized “raid” of a Capone-owned gambling casino, the Hawthorne Smoke Shop, “to make the western suburbs of Chicago fit places in which to live and raise children.” He said that as he stood at the club’s door to discourage customers, Capone himself tried to force his way by and said, “What the hell do you think this is — a party?” Bragg let Capone in, followed him into the Hawthorne and heard him berate another citizen raider, the pastor of a local church: “You’ve pulled the last raid on me you’re ever going to pull.”

In the upstairs section of the club, Bragg said he saw “pool tables and billiard tables … a roulette wheel, a chuck-a-luck table and racing forms.” Hours after Capone left, some top-level city and county police arrived with an arrest warrant, to no avail, he testified.

Now it was the defense’s turn. During cross-examination, Capone lawyer Ahern pointed out discrepancies in Bragg’s summary of the facts. However, Ahern proved ineffective, as Bragg blurted: “When I came out of the place, I was set upon by about a thousand hoodlums. I was slugged over one ear. My nose was broken with a blackjack. One of my eyes blackened — maybe two eyes — and I had to be taken to a doctor …”

More damaging testimony came next from a key prosecution witness, Lou Shumway, one of Capone’s former bookkeepers for five or six of the gang lord’s gambling clubs in Cicero, including the Hawthorne. Questioned by Assistant U.S. Attorney Jacob Grossman, Shumway said he saw Capone almost every day “in this rear room when we were going over the books and the money.”

That money from the Hawthorne flowed to a second club four doors away, called The Subway, Shumway said. The books showed Capone frequently received cash. And the clubs showed great profits, he said — more than $350,000 in 1924 and more than $117,000 in 1925 and $170,000 in 1926 (combined, $11.4 million today). During the defense’s cross, Shumway had to admit he heard about but had no hard evidence that Capone pocketed any gambling profits from the clubs, only that Capone placed wagers on races.

The following day, October 8, came the prosecution’s introduction of information provided by Capone’s former lawyer, Lawrence Mattingly, who wrote the infamous letter to U.S. income tax officials. Several tax bureau workers described the letter as proof that Capone for years avoided paying what he owed the federal government.

Defense lawyers objected to accepting the letter and Mattingly’s discussions with taxmen as evidence. Fink complained that Mattingly spoke about Capone’s finances and wrote the letter even after the feds warned that any statements might be used in court.

The judge, hearing arguments with the jury out of the courtroom, ruled the tax officials had made it clear they could introduce the letter and statements during the criminal trial. The decision rocked the defense.

On October 9, the jury heard Assistant U.S. Attorney Samuel Clawson read Mattingly’s letter, in which he confirmed that after earning incomes of $26,000 to $100,000 from 1926 to 1929, Capone never filed a tax return.

Clawson further read damning assertions that Capone made during his conferences with government tax employees. Capone revealed he had pulled out bankrolls of $100 and $500 bills each week to pay for his rooms at the Metropole and Lexington hotels and $1,633 in cash for two days of festivities during the Dempsey-Tunney fight broadcast on radio.

Capone had stated “I’d rather not answer” to questions about how he acquired $10,000 to pay for a house and whether he owned a dog track. The jury laughed when the prosecutor read Capone’s answer to a question about how long he had been earning a big income: “I never did have much of an income.”

Feedback or questions? Email blog@themobmuseum.org